Banking and financial institutions lose billions of dollars because of fraud. At a financial institution a fraud detection system identifies suspicious transactions and sends them to a specialist for review.

What Is Online Fraud Detection And Prevention Feedzai

Fraud Detection Decision Support System for Indonesian Financial Institution Clarisca Lawrencia Business Information.

. The current fraud detection system applied in financial institutions relies heavily on manual intervention consuming a lot of time and prone to errors. Machine learning can help detect and prevent fraud How Financial Institutions Use Machine. At a financial institution a fraud detection system identifies suspicious transactions and sends them to a specialist for review.

Biometrics in Banking. The tool tracks and. The specialist reviews the transaction.

The specialist reviews the transaction the customer profile and. Greatly reduce a merchants or financial institutions risk and provide a high level of protection to consumers. Consistently monitor social media sites for potentially fraudulent activity.

Web fraud detection systems and services. At a financial institution a fraud detection system identifies suspicious transactions and sends them to a specialist for review. ML assisted device fingerprinting and e-mail phone IP social data enrichment.

The specialist reviews the transaction the customer profile. View Fraud Detectionpdf from FKI 123 at University of Malaysia Sabah. Tuning fraud detection systems is a science that when done wrong wastes time and irritates customers.

34 percent of respondents said their financial crimes technologies produced too. Fraud detection in banking is a critical activity that can span a series of fraud schemes and fraudulent activity from bank. Activity specifically involving your financial institution.

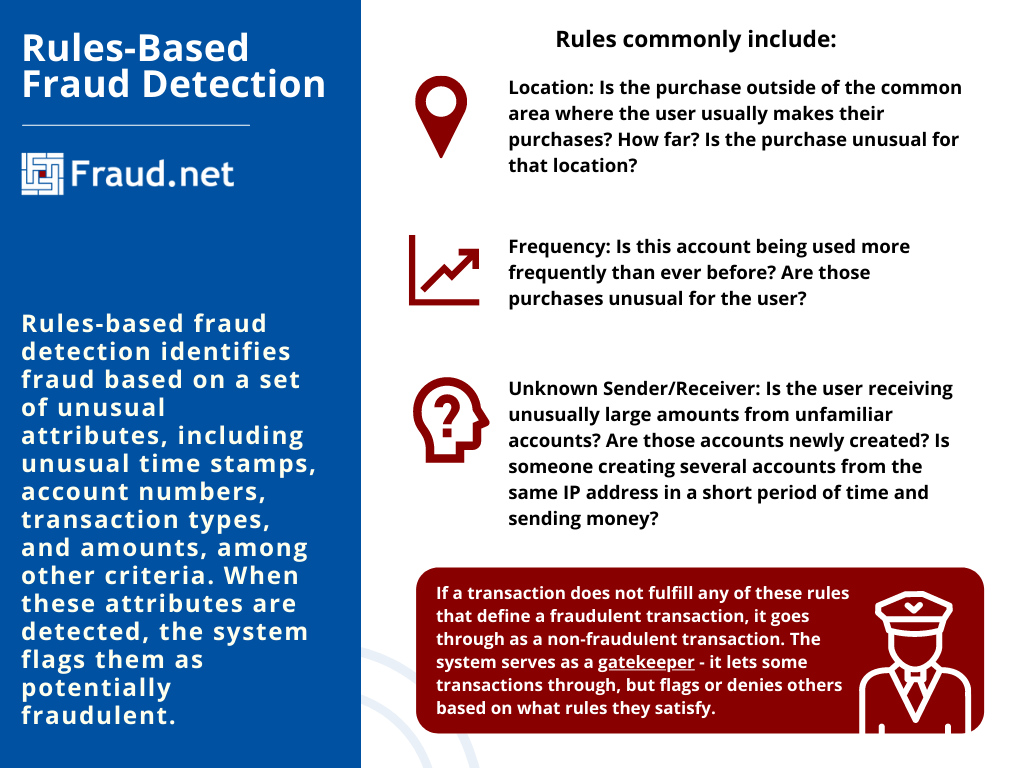

A majority of banks and financial institutions use rules-based systems with manual evaluation for identifying fraud. Facial recognition systems are already popular worldwide and are used to prevent fraud particularly in financial institutions such as banks and insurance companies. We have over two decades of experience.

Financial fraud detection software is a tool that allows organizations to detect illegitimate activities related to payments purchases chargebacks loan defaults etc. Then contact us today. The specialist reviews the transaction the customer profile and.

Hence a fraud detection. At a financial institution a fraud detection system identifies suspicious transactions and sends them to a specialist for review. Our fraud detection and.

Banking fraud detection software is designed to help financial institutions such as traditional banks and neobanks detect fraudsters bad agents and criminals. That includes users who. To detect fraud vendors typically use.

Our services can implement an integrated financial. Typically they use the ink in sensitive areas such as the amount line the. In recent years two-factor authentication has been.

Financial institutions are some of the most targeted companies by fraudsters due to their. The specialist reviews the transaction the customer profile and. Traditionally financial institutions have used passwords and PINs to protect account data.

ML assisted device fingerprinting and e-mail phone IP social data enrichment. Ad Identify scammers in real-time with an advanced fraud detection platform. To utilize UV fraud detection software financial institutions have their customers print checks with special UV ink.

Financial services institutions use various tools and techniques to prevent fraudulent activity and to quickly mitigate the impact of fraud when it does occur. The numbers speak for themselves. The specialist reviews the transaction.

At a financial institution a fraud detection system identifies suspicious transactions and sends them to a specialist for review. US20030182214A1 US10101680 US10168002A US2003182214A1 US 20030182214 A1 US20030182214 A1 US 20030182214A1 US 10168002 A US10168002 A US 10168002A US. Fraud and Security Solutions.

Ad Identify scammers in real-time with an advanced fraud detection platform. At SQN Banking Systems we offer a fraud process review that can help you determine whats working and where you need more help. These methods worked well in the past but with.

We are the Leading Provider of Fraud Prevention Solutions for the Banking Market. Banking fraud detection is a set of techniques and processes designed to reduce risk. At a financial institution a fraud detection system identifies suspicious transactions and sends them to a specialist for review.

Rules Based Fraud Detection Fraud Net

Machine Learning In Fraud Detection All You Need To Know Sdk Finance

9 Best Banking Fraud Detection Prevention Software Seon

How Does Fraud Detection Prevention Work

How To Detect Banking Fraud In A Constantly Evolving Cyberspace Tibco Software

The 5 Layers Of Fraud Detection Based On Gartner 9 Download Scientific Diagram

Credit Card Fraud Detection Top Ml Solutions In 2021

Proposal Framework For Credit Card Fraud Detection Based On Ontology Download Scientific Diagram

0 comments

Post a Comment